The exempt rate for overnight accommodation allowances is the total reasonable amount for daily travel allowance expense using the lowest capital city for the lowest salary band for the. The maximum capital cost of each vehicle that may be included in Class 101 is now 30000 plus GST and provincial sales tax PST or HST.

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

Motor Vehicle Modificatio ns.

. The deposited amount can then be claimed as a deduction from capital gains and. If you have received a non-taxable motor vehicle allowance and can show that the employment-related motor vehicle expenses are in excess of the allowance and voluntarily include the amount of the allowance in income you can deduct your motor vehicle expenses if conditions 1 2 and 4 are met. Q A - Motor Vehicle Faded Plates.

You acquired it after August 31 1989 and before January 1 1997 and it cost you more than 24000. The type of vehicle that you own. The exempt rate for overnight accommodation allowances is the total reasonable amount for daily travel allowance expense using the lowest capital city for the lowest salary band for the.

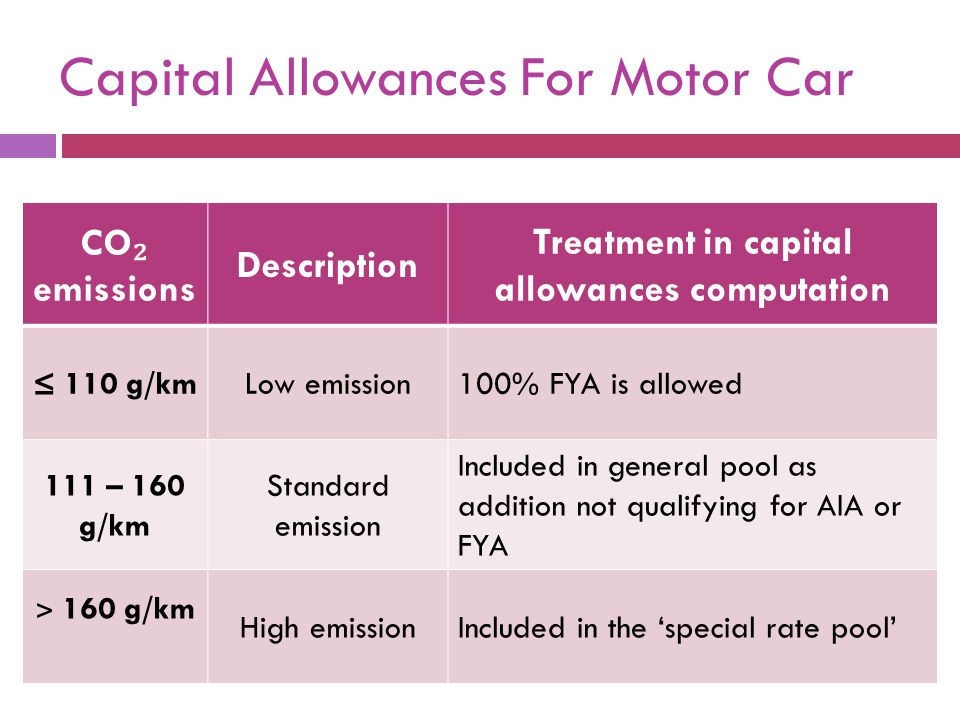

If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2021 the amount increases to 10200. The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200. Battery Electric Vehicles BEV have no tail pipe emissions of CO 2.

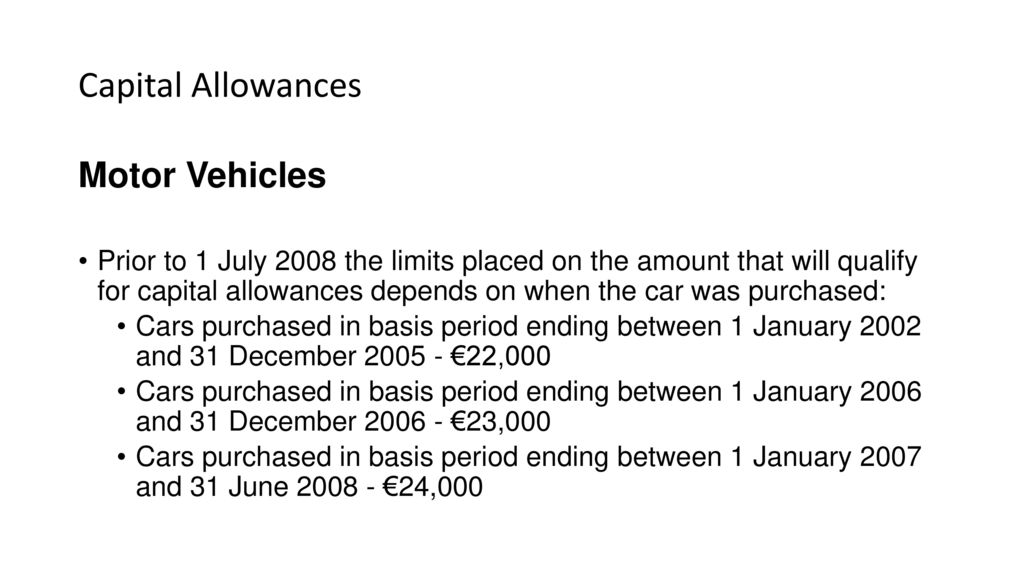

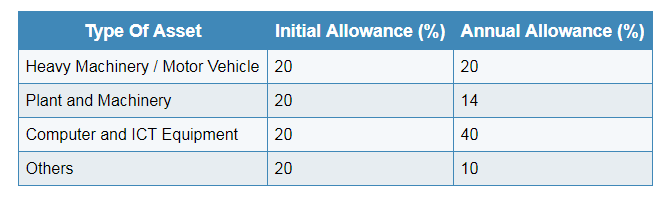

A Motor vehicle is an automotive vehicle designed or adapted for use on highways and streets. However you may be able to claim capital cost allowance on repaired property. Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is.

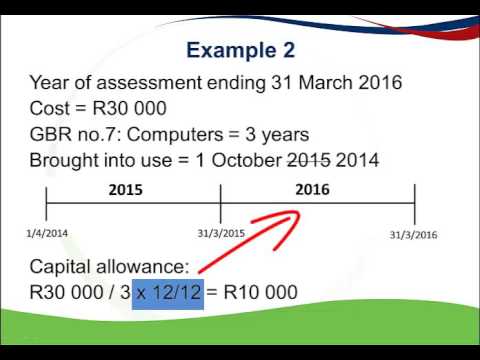

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021. Basic assessable income has the meaning given by subsection 392-452. You claim a deduction over a period of several years based on the depreciation percentage until it wears out or has no value left.

Include your passenger vehicle in Class 101 if it meets one of the following conditions. Car A car is a motor vehicle that is designed to carry. For more information see the section Motor vehicle expenses in Guide T4002 Self-employed Business Professional Commission.

To calculate CCA list all the additional depreciable. For more information see Class 101 30. A reimbursement is an amount you pay to your employee to repay expenses they incurred while carrying out the duties of employment.

The grant amount is deducted from the total price agreed for your new Electric Vehicle. When you look at Area ASchedule 8 you will see a table with eight different columns and a separate chart for Motor vehicle CCA. An allowance can be calculated based on distance time or something else such as a motor vehicle allowance using the distance driven or a meal allowance using the type and number of meals per day.

VRT and annual Motor Tax bands for vehicles. The capital cost limits on a Class 101 vehicle a passenger vehicle still apply when you split the capital cost between business and personal use. For more information about capital cost allowance see Guide T4002.

Note that goods and services tax GST and provincial sales tax PST or harmonized sales tax HST should not be included when calculating the cost. Drivers - Lost Documents. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

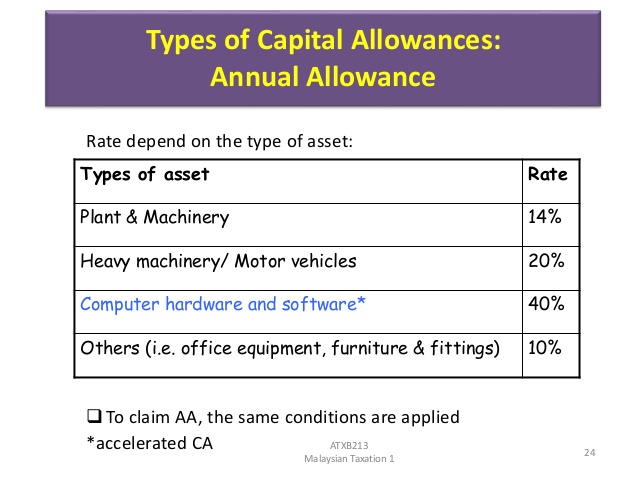

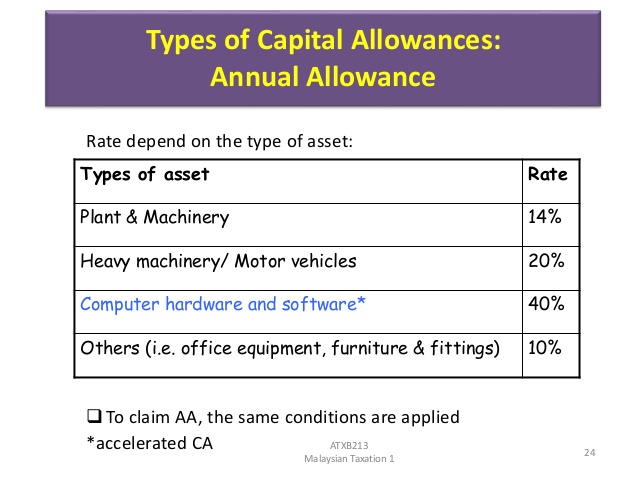

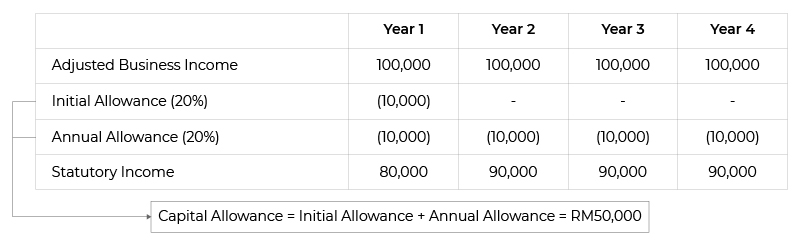

Capital allowance is only applicable to business activity and not for individual. On a new motor vehicle the credit or trade-in value allowed by the seller shall be deducted from the total consideration for the new vehicle to establish the purchase price. Learn how to calculate capital cost allowance CCA for your Canadian business income and to fill out your tax return with this guide to the CCA schedule.

A motor vehicle allowance can be paid on the basis of an amount per business kilometre travelled by the employee or as a regular flat or fixed amount. Used for motor and passenger vehicles that cost more. If you own your car you can claim the capital cost allowance CCA.

For 3-year terms which are renewable. Drivers Licence - Frequently Asked Questions. Any vehicle not classed as a motor vehicle The Canada Revenue Agency provides a chart of vehicle definitions for vehicles bought or leased after June 17 1987 and used to earn business income.

When purchasing a vehicle the dealer will apply for the grant for you. Q A - Motor Vehicle Transactions. If the driver is under the influence of drugs or abuse the motor vehicle insurance policy wont cover it.

For your motor vehicle. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. Types of motor vehicles The type of motor vehicle you drive can affect how you calculate your claim.

2 For a used motor vehicle sold or leased by a licensed motor vehicle dealer the total consideration for the used motor vehicle whether received in money or otherwise. Base year in relation to an income year has the meaning given by sections 45-320 and 45-470 in Schedule 1 to the Taxation Administration Act 1953. Not having a valid driving license when the motor vehicle has met with an accident can result in claim rejection.

A motor vehicle is either a car or an other vehicle. You can also claim Capital Cost Allowance CCA but enter this amount on Line 9936 Capital cost allowance. Many four-wheel drives and some.

Basic concessional contributions cap means the concessional. A motor vehicle does not include a trolley bus or a vehicle designed or adapted to be operated only. We would like to show you a description here but the site wont allow us.

Base value of a depreciating asset has the meaning given by subsection. Motor Vehicle Drivers Licence Fees - brochure. A motor vehicle allowance can be paid on the basis of an amount per business kilometre travelled by the employee or as a regular flat or fixed amount.

VRT is paid whenever a car. Claim a maximum of 30000 tax in the year of addition. Section 179 deduction dollar limits.

The car two wheeler commercial vehicle is used for illegal activities or a purpose otherwise stated in the policy. Adjunct membership is for researchers employed by other institutions who collaborate with IDM Members to the extent that some of their own staff andor postgraduate students may work within the IDM. Publications for Motor Vehicles.

Claiming CCA for a work space in the home can have a negative effect for purposes of the principal residence exemption. A load of less than one tonne and fewer than 9 passengers. You cannot deduct costs you incur for capital repairs.

If capital gains earned have not been invested till the date of filing of income tax return usually 31 July of the financial year in which the property is sold the gains can be deposited in a PSU bank or other banks as per the Capital Gains Account Scheme 1988.

Introduction Capital Allowances Depreciation Specifically Disallowed Ppt Download

F6 P6 Capital Allowances Youtube

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Capital Allowance Liberal Dictionary

Capital Allowance Calculation Malaysia With Examples Sql Account

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Ttcs Accelerated Capital Allowances For Machinert Equipment Including Ict Equipment P U A 268 2021 Thannees

.jpg)

Financing And Leases Tax Treatment Acca Global

Ms 3255 Business Taxation Capital Allowances Plant And Machinery Ppt Video Online Download

Preparing The Capital Allowance Computation Acca Taxation Tx Uk Youtube

The Tax Benefits Of Electric Vehicles Saffery Champness

Preparing The Capital Allowance Computation Non Pool Assets Acca Taxation Tx Uk Youtube

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

2016 Capital Allowances Sec 11 E General Wear And Tear Youtube

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

Capital Allowance Super Deduction What Does It Mean For Motor Dealers

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Balancing Adjustments On Pools And Review Of Capital Allowance Computation Acca Taxation Tx Uk Youtube